Comprehensive Transaction Services

Comprehensive Transaction Service Platform e-Haitong Ju

In order to better adapt to the ever-changing market and meet the trading service needs of various types of core

clients, the Company provides clients with a customized comprehensive trading solution-"e-Haitong Ju". Over the

past three years, the Company's trading service team has worked closely with the Business Department to provide

various types of agency trading services for high net worth and institutional clients, and have successfully entered

into contracts with 106 relevant institutional platforms and major shareholders, with assets under custody of more

than RMB 120 billion, helping more than 200 listed companies to exit with a total of RMB 12.2 billion in capital; the

Company cooperates with several large private equity institutions to help build a complete "investment, financing,

management and exit" equity eco-chain.

Outstanding Cases

By providing shareholding reduction services for shareholders, the Company has established a long-term

relationship with Fengyuzhu. Based on the characteristics of its shareholders, the Company developed a

personalized exit plan. In 13 trading days, the Company successfully reduced shares by a total of 5,963,500

shares through bidding, with a turnover amount of RMB 92,169,900, at a price that was 1.68% higher than the

average market price during the period.

The Company worked closely with Dosilicon and successfully accomplished the share buyback task with high

efficiency and outstanding performance. In only 3 trading days, the Company successfully helped it to repurchase

918,400 shares, with a total turnover of RMB 27,315,200, and at a price 1.42% lower than the average market

price during the period.

One-stop Intelligent Trading Platform e-Hai Ark

"e-Hai Ark" is a one-stop intelligent trading platform independently developed by the Company for institutional clients and professional investors, integrating high-speed trading, intelligent algorithms, high-speed quotations, strategic trading, ETF arbitrage and other functional services, and building up core competitiveness of serving high-quality client base through the empowerment of FinTech.

Featured Sections

Specialized Over-the-Counter Trading System

Through the optimal selection of high-speed hardware and software counters, the Company meets the general and professional needs of institutional investors, and provides clients with the ultimate trading performance and efficient service response brought about by low latency.

Specialized Trading Terminals

The Company provides professional investors with a variety of trading terminals such as "e-Hai Ark" series, Hundsun PB, Think Trader PB, etc., with full service authorization and support for high-speed trading, arbitrage trading, portfolio trading, strategy algorithms, etc., to satisfy investors' differentiated and diversified trading needs and personalized use scenarios, and to enhance the trading experience of investors in a comprehensive manner.

Customized Trading System

By purchasing client-specified trading system, the Company is able to achieve a high degree of coupling between clients' trading strategies and the trading system, helping investors to enhance the efficiency of trading strategy execution and optimize the effect of trading strategy execution, providing institutional investors with a package of comprehensive trading service solutions.

High-speed Quotation Services

Relying on Haitong's high-speed trading counter and FPGA quotation support, the Company provides stable and efficient network deployment and a wide range of high-frequency quotations to meet the needs of institutional clients for high-speed trading and quotations.

Scenario-based Algorithmic Strategy Services

The Company has cooperated with algorithm suppliers to build Haitong Fang Zhou Algorithm Mall, introducing 50+ mainstream order splitting algorithms and 7 intelligent T0 algorithms from the market; through dynamic algorithm performance analysis, the Company selects the best algorithms to help clients solve the strategy execution problems and improve the strategy performance.

OTC Derivatives

By utilizing its own funds and derivative financial instruments, the Company satisfies the demands of clients for strategic investment, wealth management, global asset allocation, risk management, etc.

OTC options

The Company provides clients with OTC option trading services based on equity, FICC, cross-border and quantitative strategy index assets. By designing various OTC option structures, the Company serves the real economy through product creation and meets the needs of various institutional clients for wealth management, global asset allocation and risk management.

Long/short return swap

The Company provides electronic swap trading and hedging services for quantitative long/short strategies to improve the efficiency of capital utilization and provides efficient and stable system solutions.

Cross-border return swap

The Company offers flexible cross-border swap trading arrangements to meet the needs for cross-border secondary market investments or hedging transactions, and provides cross-border, cross-market, multi-asset cross-border trading solutions.

Income certificates

The Company has deepened its service value chain by launching the "Ying" series income certificates, which are categorized into "Wen Ying", "Bo Ying" and "Zhi Ying" in terms of risk dimensions from low to high. Depending on clients' investment objectives and risk tolerance, the Company builds a multi-object, multi-directional and multi-structured investment toolbox to provide innovative wealth management products for clients in the over-the-counter market.

Institutional Sales

The Company provides research service-based specialized integrated services to domestic and overseas financial institutions such as public funds, social security, banks, bank wealth management subsidiaries, insurance and insurance asset management companies, private funds, QFII, WFOE, etc. It also provides one-stop services combining online and offline services to top domestic and overseas institutions, and companion services to growing clients in order to build an integrated ecosystem.

Public Funds and Insurance Business

The Company provides public funds and insurance institutions with investment research services,distribution services, securities margin trading business, derivatives business, custodian business,block trade matchmaking services, digital finance business, etc. The Company also builds publicity and display platforms such as "Hai Xing Shuo" and "E Yan Jiu Ding", which help enhance the influence and reputation of its clients' brand names.

Private Fund Business

The Company has effectively established a comprehensive ecosystem integrating investment andresearch, trading, products, and investment management for private equity clients, both onshore and offshore, and provides prime brokerage business including but not limited to investment and research consulting, product custody and outsourcing, customization of trading systems (PB, over-the-counter, and various types of algorithms), securities lending and capital intermediation, OTC derivatives, private equity fund distribution, and capital referrals.

Banking Business

The company provides services for state-owned banks, joint-stock banks, top-tier urban and ruralcommercial banks and financial subsidiaries of various banks, including but not limited to investment and research consulting services, customization of main brokerage households and trading systems, asset management and advisory services and over-the-counter derivatives services, and provides customized services for domestic and foreign transactions, products, investment management and other services based on customer needs.

International Business

The Company ranks high in QFII business and has entered into in-depth cooperation with varioustypes of overseas institutions, including sovereign funds, pension funds, active managers, hedgefunds, investment banks, commercial banks, insurance companies, etc., involving investment andresearch, trading, primary and secondary capital markets and other areas, and has gradually become an important partner for overseas institutions to develop their business in China. Haitong's offshore institutional trading desk, as the first trading desk established in China, has rich trading experience, is equipped with stable and powerful system and IT support, and provides diversified institutional services for offshore clients through mature self-developed algorithmic platform as well as mature and flexible program trading support.

Comprehensive Service Platform for Institutional Clients

e-Haitong Da

"e-Haitong Da" platform gives full play to the synergistic effect, unites the resources across the Group's various

business lines, integrates the functions of research, investment banking, trading, custody, corporate services, and

so on, to satisfy the investment and financing needs of institutional clients and listed companies in an all-round way.

"e-Haitong Da" platform provides multi-service terminals and access modes: portal, APP, and mini program, unified

institutional APIs to meet various business scenarios and create a one-stop, full-cycle and integrated institutional

service ecosystem.

Bank Wealth Management Subsidiary Services

The Company provides bank wealth management subsidiaries (BWMS) with independent trading channels, trading seats and trading systems, ensures the efficiency of valuation upon liquidation, and customizes personalized account statements.

It offers guaranteed settlement amount for pledged bond repo businesses, provides PB services that can be extended, provides OTC subscription of public funds, as well as timely liquidity supports and other services.

It provides securities margin support for the managers related to the investment made by using financial management funds. It also offers management, performance evaluation, valuation outsourcing and other management services for their products. It provides a package of research support for fixed income, equity investment, and so on.

It supplies underlying assets for bonds, IPO, private placement and PE. It customizes derivatives (return swap, OTC options, income certificate, etc.).

It provides strategic support for FOF and other investments.

It recommends excellent managers and offers other resource and business support.

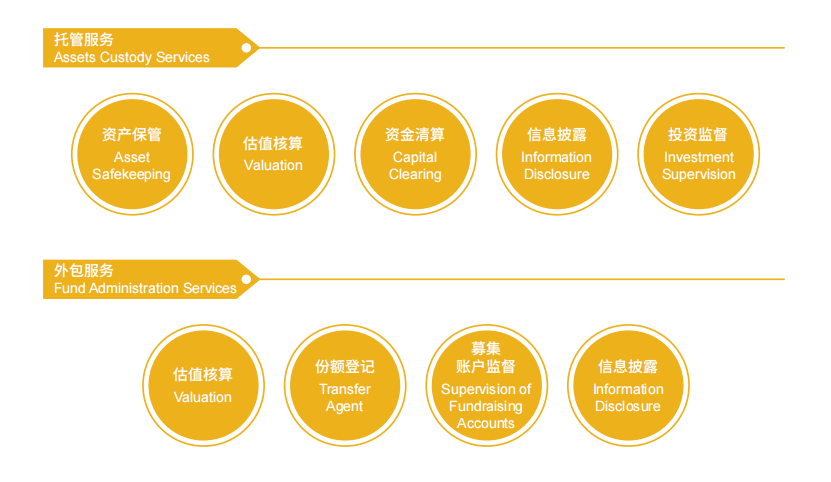

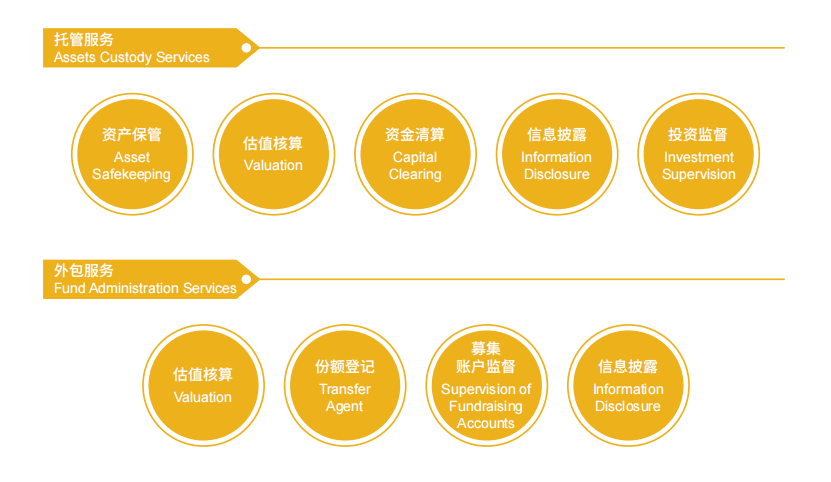

Assets Custody and Fund Administration Services

The Company provides comprehensive and high-quality assets custody and fund administration services for various asset managers, and provides value-added services such as product design, performance analysis, capital intermediation, and personalized statement customization around the above basic services.

Types of products the Company serves: various types of public funds, private funds, SMA products for funds and fund subsidiaries, brokers' asset management plans, futures asset management plans, and other types of public, private and asset management products under the regulation of the CSRC.